You can entry payroll data, list of banks, subsequent payroll run date and extra from a single dashboard. Whether Or Not you wish to arrange paid day with no work or maximum allowed additional time or a pay cycle, it’s so easy as selecting the given choice. A payroll software service is a good addition to any company, however it may possibly solely take you so far. When choosing the right payroll provider for your wants, it’s necessary to contemplate ease of use, integrations, customer assist, and bonus features. Meanwhile, payroll providers like QuickBooks Payroll can streamline the method and assist your employees get paid sooner with direct deposit.

Yes, every QuickBooks Payroll plan contains computerized payroll tax calculation, deductions, and submitting. Not Like some competitors, like ADP, QuickBooks Payroll also routinely information end-of-year tax types like W-2s at no further cost. A variety of payroll providers are offered by QuickBooks, including Fundamental, Enhanced, and Full Service. For instance, a smaller startup might select the Primary plan owing to its straightforwardness and reduced price. Conversely, a well-established enterprise might require the Full Service plan for its in depth functionalities, similar to automated tax submission and payroll help https://www.quickbooks-payroll.org/.

Step 1: Rent A Professional Payroll Specialist Or Company

This weblog explores the intricacies of how to do payroll in QuickBooks, guaranteeing a streamlined and compliant process for organizations of various scales. Strictly Essential Cookie must be enabled always in order that we are in a position to save your preferences for cookie settings. Golden Apple Company Inc and its staff are impartial QuickBooks ProAdvisors. Your business’s details are stored safely on the Intuit servers (if using QuickBooks Online). Find help articles, video tutorials, and connect with different businesses in our on-line group. We will help you transfer any current payroll info to QuickBooks.

Payroll Services Made To Grow With You

Payroll is a complicated task for companies, particularly these new to finance administration. Navigating the intricate calculations and tax withholding with out prior expertise results in errors, penalties, and extra. It helps businesses accurately calculate worker wages, taxes, and deductions and generate paychecks or direct deposits.

QuickBooks Payroll lets you supply aggressive advantages to your workers. It provides workers’ compensation by way of AP Intego and well being benefits, affordable medical, dental and vision insurance packages by SimplyInsured. Yes, QuickBooks Payroll permits you to arrange totally different pay schedules, corresponding to weekly, biweekly, or monthly. It additionally helps various worker types, together with hourly, salaried, and contract staff, with totally different pay buildings. QuickBooks Payroll uses sturdy encryption and multi-factor authentication to protect your payroll data. These measures help secure sensitive info and stop unauthorized entry.

How To Cancel Payroll In Quickbooks

Having made all needed changes in the earlier step, it’s time to evaluation all the small print before you finalize payments. Double-check worker hours, wages, tax deductions, and any advantages or changes to be sure every thing is so as. These tools deal with every little thing from paycheck calculations to tax payments and form filings, saving you time and decreasing the chance of expensive errors. Whereas handbook calculations are potential, utilizing small business payroll software program can save time, scale back errors, and decrease the worth of payroll.

Your employees is dependent upon timely paychecks to cover essential expenses like lease or mortgages, utilities, loans, food, medications, and more. With an environment friendly payroll processing system, you’ll have the ability to ensure on time cost to your staff. While you get financial savings by doing payroll your self, time and effort are the true prices.

All you need to do is enter the small print of all your employees, set up payment rules and fix the day their payroll should run. QuickBooks Payroll is a wonderful app from Intuit for managing worker payroll for a small business. If you are already using QuickBooks Online for accounting, the 2 integrate seamlessly, enabling you to handle both accounting and payroll from a typical platform. QuickBooks Payroll additionally made it to our listing of best payroll software for small businesses. Yes, QuickBooks Payroll can manage tax filings for multiple using quickbooks for payroll states, as lengthy as you enter the right state-specific tax data.

Subsequent, input hours worked, extra time, bonuses, or commissions for the payroll interval. Pay attention to this evaluation to avoid overpayments, underpayments, or incorrect tax filings, and guarantee your team is paid correctly and on time. QuickBooks also handles payroll taxes for sure plans by submitting them routinely for you! Nonetheless, customers of Basic or lower-tier plans could need to file taxes manually. Hold in mind that there’s usually a short delay between the end of a pay period and payday, which provides you time to calculate hours labored, taxes, and other deductions. You must also examine along with your state labor company, as some states have laws that dictate how usually employees should be paid.

- Workers can submit their very own pay preferences, private particulars, and tax data, so you probably can add them to your payroll with out the hassle.

- After every payroll run, you need to update your information to reflect all funds, deductions, and adjustments.

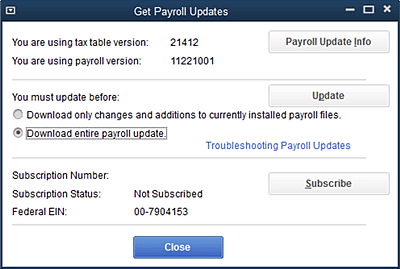

- After activating the payroll subscription, all you should do is ready it up.

- If you run payroll late, your organization may be penalized and you could be charged interest on the lacking funds.

- Shield your payroll information by implementing proper access controls, sustaining backups, and staying vigilant towards potential cybersecurity threats.

You can even choose to approve every month’s payroll before disbursement or set it to run routinely. You can add staff member—employee or impartial contractor—details manually or import from external sources, such as spreadsheets or previous payroll purposes. If you’re including them manually, you can start simply with the name and e-mail tackle.