If your materials waste is high, look at ways to redesign your manufacturing process to reduce this waste. Review your entire gross sales chain to identify areas that may benefit from automation.

Utilizing LIFO, the jeweler would list COGS as $150, regardless of the price initially of production. Utilizing this methodology, the jeweler would report deflated internet income costs and a lower ending steadiness within the stock. During inflation, the FIFO method assumes a business’s least costly merchandise promote first. This process might lead to a lower cost of products sold calculation compared to the LIFO methodology.

Precisely measuring and watching these costs helps companies stay competitive and value offerings. The cost of gross sales line item on a company’s income statement permits traders to have a first have a look at the profitability of the production course of. The value of gross sales (or sometimes price of excellent sold) is deducted from a company’s revenue to reach at the company’s gross profit. COGS includes solely the direct costs of producing items, corresponding to raw supplies and direct labor. This focus excludes indirect costs like overhead, administrative expenses, and advertising costs. While this provides readability on the direct profitability of merchandise, it omits vital expenses that can have an result on the general profitability of the corporate.

Terms and conditions, features, support, pricing, and repair choices subject to vary without discover. Understanding how COS differs throughout business fashions helps tailor strategies to maintain profitability and competitiveness. When you purchase in additional goods than you promote, it may look as though you may have made a loss and don’t have any tax to pay. But there’s an additional adjustment to make in your accounts to mirror that you nonetheless own some of the gadgets. Second, Mary adds the beginning inventory and subtracts the ending inventory to calculate the price of items manufactured, which is $175,000. In product-based corporations, it is often referred to as what does cost of sales mean Price of Goods Offered (COGS), while service-based firms may use the term Value of Providers (COS).

Decide Internet_

At the top of the present yr, the corporate is left with $10,000 value of unsold t-shirts. A service enterprise https://www.kelleysbookkeeping.com/ will usually not have the standard product stock present in a producing or retail company. Nonetheless, longer-term service projects that aren’t yet full could be handled as “inventory” or really a service not yet delivered to the customer.

Understanding Accountancy Terms: Price Of Sales

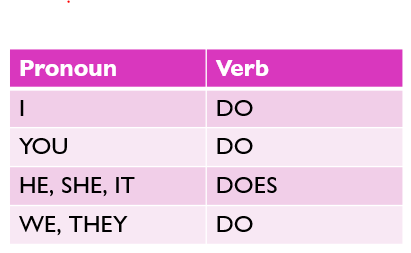

Businesses select a list accounting system to trace items and decide COGS. The two major systems are the Perpetual Inventory System and the Periodic Inventory System. These methods dictate how stock levels are up to date and COGS is calculated.

Cost Of Gross Sales: That Means, Method And Calculation

- Nicely, they should know that both are basically the identical factor and are sometimes used interchangeably.

- When tax time rolls around, you can embody the cost of buying inventory in your tax return, which could reduce your business’ taxable income.

- Understanding your initial prices and maintaining correct product prices can in the end prevent money.

- Lock in a free chat with certainly one of our pleasant in-house experts for an honest dialogue about enhancing your operations and value monitoring.

These firms and a lot of others select to not report product sales; instead, they current internet sales on their monetary statements. Web sales already have reductions, returns, and different allowances factored in. Gross sales measures a company’s total gross sales with out adjusting for the bills of producing those sales.

What Is Cost Of Gross Sales And Tips On How To Calculate It

This variability can lead to challenges in budgeting and monetary planning, as sudden increases in prices won’t instantly correlate with will increase in gross sales. Since COGS does not account for all working bills, the gross revenue (revenue minus COGS) would possibly give an inflated view of profitability. Usually, as soon as you determine value of goods bought, it’ll allow you to decide how much you owe in taxes at the finish of the reporting period—usually 12 months.

The gross sales figure is calculated by adding collectively all gross sales receipts earlier than discounts, returns, and allowances. The price of products bought may additionally be impacted by the sort of costing methodology used to derive the price of ending inventory. For instance, underneath the first, first out method, known as FIFO, the first unit added to stock is assumed to be the first one used. Thus, in an inflationary surroundings where costs are growing, this tends to result in lower-cost items being charged to the price of goods offered. The reverse strategy is the last in, first out methodology, known as LIFO, where the last unit added to inventory is assumed to be the primary one used. Thus, in an inflationary environment where prices are increasing, this tends to end in higher-cost goods being charged to the price of goods sold.